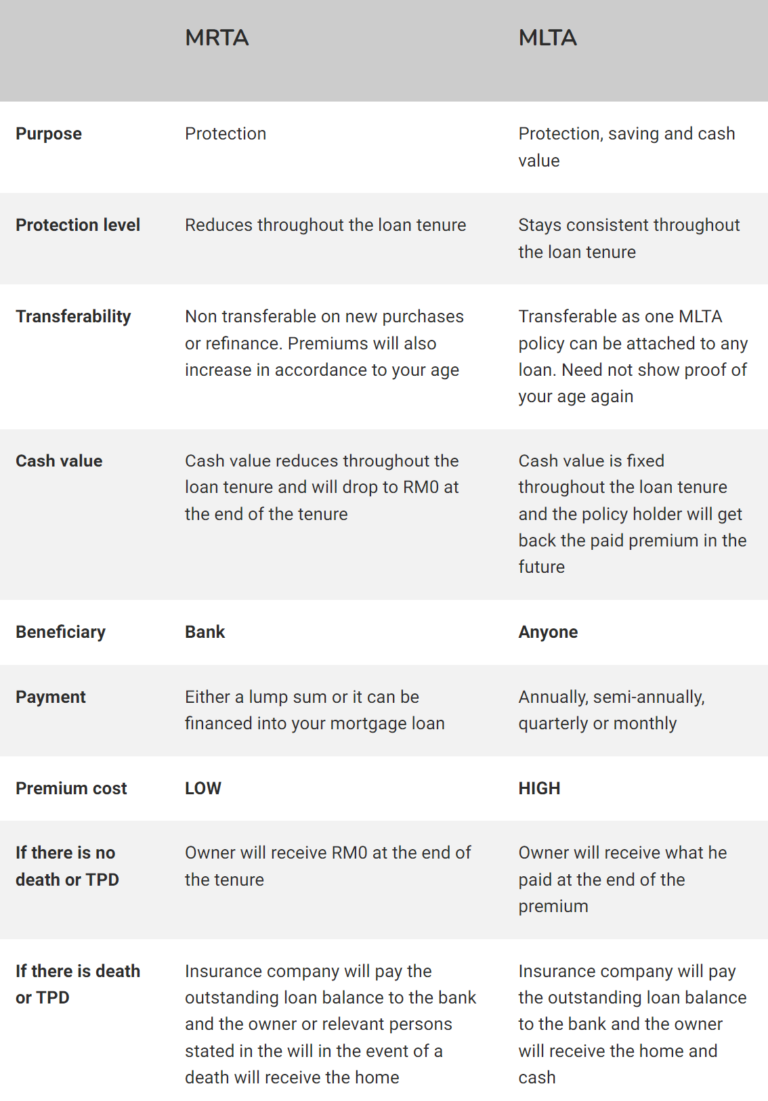

MLTA offers greater protection as the amount insured remains the same throughout the life of the loan, even though the amount that you owe the bank will decrease over the years.

This means that on top of mortgage protection, an MLTA also is also a form of savings and has a guaranteed fixed cash value throughout the tenure of the loan.

In comparison, the amount insured under MRTA declines each year and will reach zero at the end of 30 years.

Moreover, only the lender will be entitled to the insurance payout under MRTA, while you can nominate anyone to be the beneficiary under an MLTA insurance policy.

Furthermore, since the MRTA is calculated based on the loan amount plus interest rates at the time of purchase, and since home loan interest rates in Malaysia can increase, there’s a risk that the MRTA’s value declines at a faster rate than the remaining loan value.

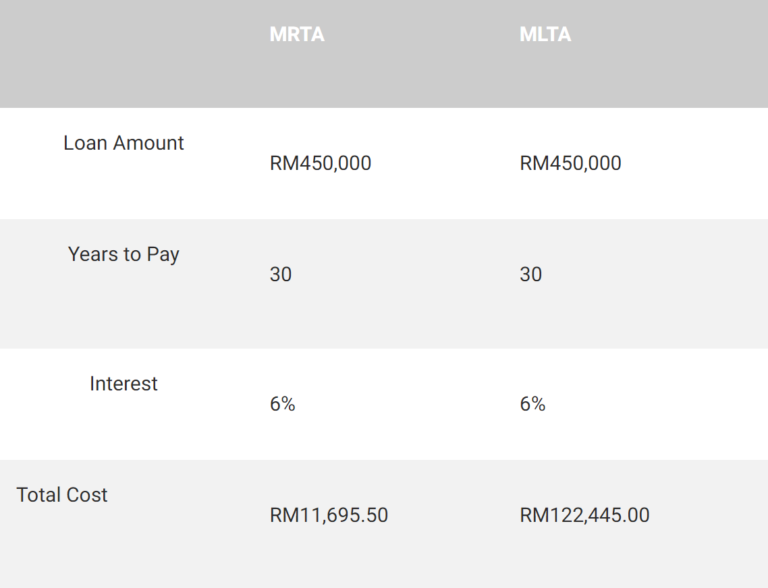

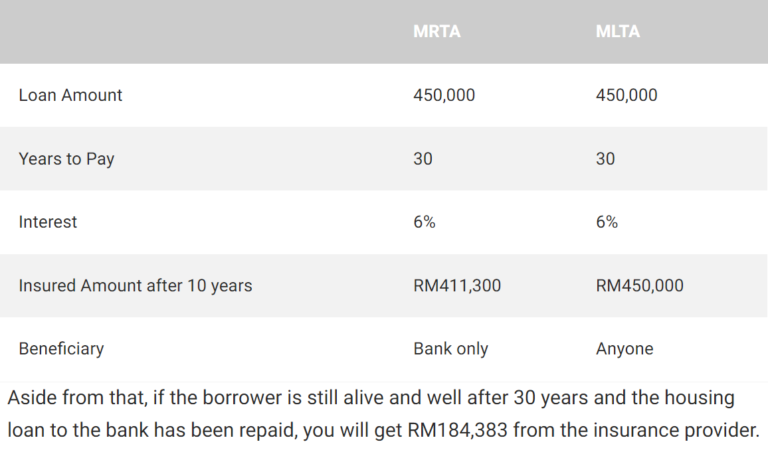

Here’s a simplified example:

Under an MRTA scenario, if a borrower has been diligently paying his RM450,000 housing loan but suffered death or permanent disability after 10 years, the bank will receive RM411,300 from the insurance provider to pay off the loan.

If there has been an increase in interest rates, this amount may be insufficient to cover the remaining loan balance.

This means the borrower’s family may still need to fork out some cash to fully repay the mortgage, otherwise they’ll lose their home.

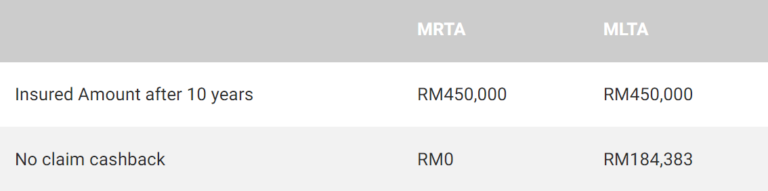

If there are no untoward incidents and the borrower successfully pays off the loan in 30 years, he/she will get nothing from the MRTA policy.

Safe to say, he/she would not have accumulated any savings that can be cashed in upon maturity of the policy.

Under an MLTA scenario, if anything happens to you, your family will always receive RM450,000 from the insurance provider to pay off the remaining balance of the housing loan.

Any difference between what is owed to the bank and the value of the policy will go to your family. This is why an MLTA is often regarded as a form of life insurance as well.