Version: CN

The Home Ownership Program (HOC) was a hot topic among first-time home buyers. However, in July 2022, the government announced a new home purchase policy, the Malaysian Home Ownership Initiative (i-MILIKI), to help first-time homebuyers reduce the burden of buying a home.

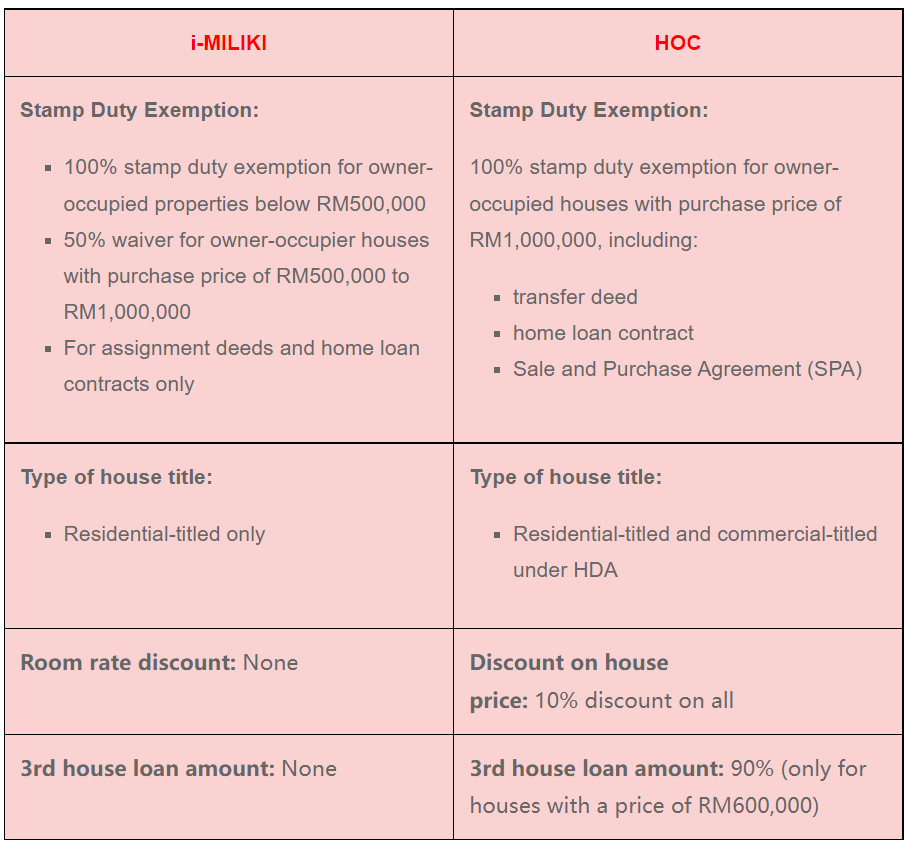

i-MILIKI is also called “HOC 2.0” by many people in the industry, since both offers the same relief measure, which is the stamp duty exemption. Curious to know more about i-MILIKI? Discover its special features here!

1. What is i-MILIKI?

The Malaysian Home Ownership Initiative (i-MILIKI) is a new home ownership program launched by the government, which aims to provide sufficient affordable and quality housing for young people and low- and middle-income groups in Malaysia.

First-time homebuyers who purchase a home through the i-MILIKI initiative will enjoy two tax deductions:

Stamp Duty Exemption for Loan Contracts

Stamp Duty Exemption on Assignment Deeds

So, how can first-time buyers enjoy these two stamp duty reductions?

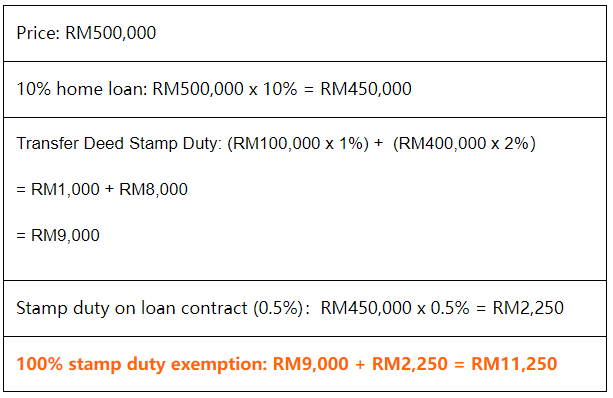

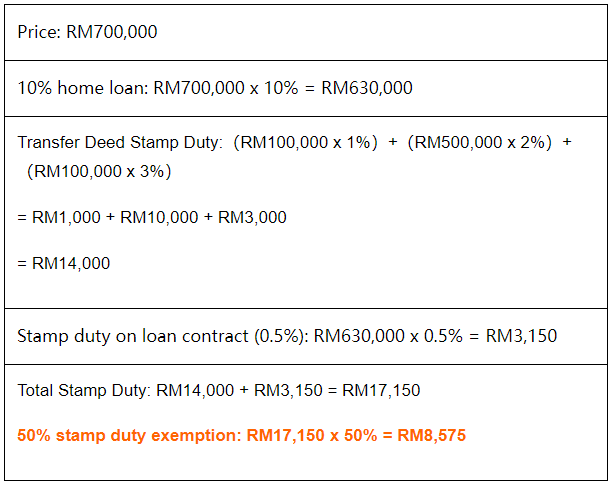

- Purchasing a house below RM500,000: 100% stamp duty exemption

- Purchasing a house from RM500,000 to RM1 million: 50% stamp duty exemption

However, the i-MILIKI initiative is limited within the period of June 1, 2022 to December 31, 2023, and discounts can be enjoyed by signing the Sales and Purchase Agreement (SPA).

As long as first-time homebuyers purchase new real estate projects, or homes by developers participating in this initiative, they can enjoy these i-MILIKI discounts.

Do note that this initiative is limited to residential-titled properties. Commercial-titled and commercial-titled under HDA properties (e.g. SOHO, serviced apartments) are not covered.

2. What are the benefits of i-MILIKI for first-time homebuyers?

The implementation of i-MILIKI has undoubtedly brought the dawn of “buying a house to save money” for first-time buyers.

With this effort to reduce stamp duties, first-time homebuyers get to have a lower burden of buying a house, making it easier for them to own a home.

How does the government help first-time homebuyers save money through the i-MILIKI initiative?

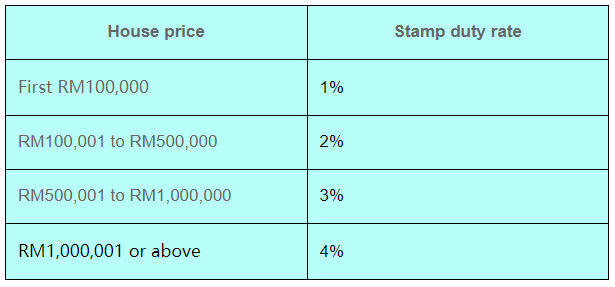

First of all, let’s go through the stamp duty rates stipulated by the government: