OPR Increased to 2.50%: How Does This Affect Housing Loans?

On 8 September 2022, Bank Negara Malaysia raised its Overnight Policy Rate (OPR) by 25 basis points (bps) to 2.50%. The ceiling and floor rates of the OPR’s corridor are increased to 2.75% and 2.25%, respectively.

By IQI

OPR 2022

September update

On 8 September 2022, Bank Negara Malaysia raised its Overnight Policy Rate (OPR) by 25 basis points (bps) to 2.50%. The ceiling and floor rates of the OPR’s corridor are increased to 2.75% and 2.25%, respectively.

July update

As at 6 July 2022, Bank Negara Malaysia increased the Overnight Policy Rate (OPR) by 25 basis points to 2.25%, with ceiling and floor rates of the corridor of the OPR correspondingly increasing to 2.5% and 2% respectively.

May update

On 11 May 2022, Bank Negara Malaysia announced the increase of the Overnight Policy Rate (OPR) by 25 bps from 1.75% to 2%, in line with “the sustained reopening of the global economy and the improvement in labour market conditions continue to support the recovery of economic activity”.

What is Overnight Policy Rate (OPR)?

Before we dive in deeper, let’s have a look at what OPR is all about.

The Overnight Policy Rate (OPR) is an overnight interest rate set by Bank Negara Malaysia (BNM), which determines the interest rate for financial institutions to lend funds to one another.

Depending on the bank’s lending activities as well as the customers’ deposits and withdrawals, banks have varying levels of cash reserves on a daily basis.

Thus, banks with a cash shortage often borrow from banks with larger cash reserves in order to balance the available levels of cash, which in turn ensures a stable banking system. Maintaining this balance is crucial to keep financial systems functioning, as well as meet the liquidity requirements set by BNM.

To ensure banks have a steady amount of available cash, the interest rates fixed by the OPR provides a structure for monetary direction on a national scale. Due to its significance in banking operations, the OPR can affect the economy in various ways, including employment and inflation.

What does this mean to home buyers and businesses?

A higher OPR means that the borrowing cost will become more expensive for consumers. Banks will revise the costs following the increase in OPR by BNM, resulting in higher interest rates for home buyers and businesses. The higher cost can limit personal and commercial access to capital.

A lower OPR, on the other hand, brings the opposite result. 2020 recorded the lowest OPR rate at 1.75%. Learn how a lower OPR can affect the property market here.

The increase in OPR results in:

1. Higher monthly installment payments

The higher interest rates make the cost of borrowing more expensive, resulting in a hike in monthly installment payments.

2. Longer loan tenure

Thanks to the increase in the monthly installment amount, the repayment period will be extended if the old sum is maintained.

Since most housing loans in Malaysia are Full Flexi Loans or Semi Flexi Loans, this means that your monthly payment will fluctuate with the rise and fall of OPR.

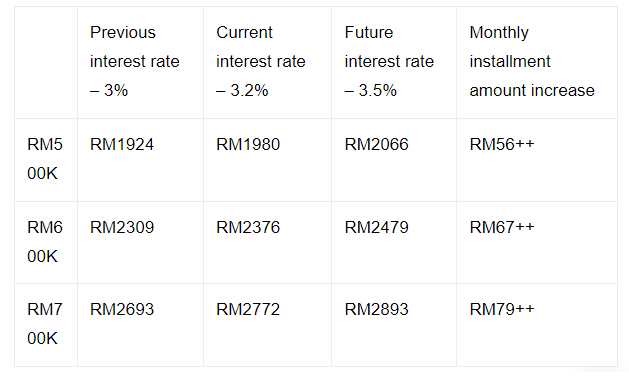

The chart below shows a rough idea of the changes in monthly payments after the OPR increase:

Credit: Andy Foong, IQI Real Estate Negotiator

Note that this information is only for reference – interest rates and percentages vary from bank to bank. Please check with your bank for the latest updates.

Is This a Good Time To Buy a Home?

Rates are expected to hike up by year end as BNM focuses on ensuring a sustainable recovery of the Malaysian economy. Knowing this, it’s safe to say that this is a good time to leverage on this opportunity and start purchasing property before rates start going up again.