Will Writing

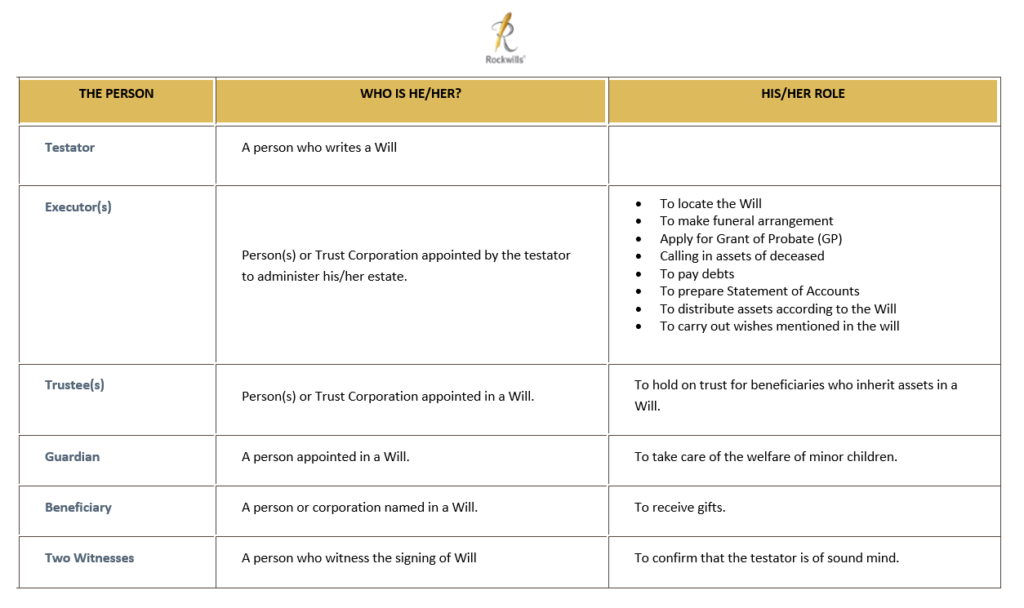

A Will is a legal document you draw up to declare your wishes for your loved ones as to how you want your assets to be distributed after you passed on.

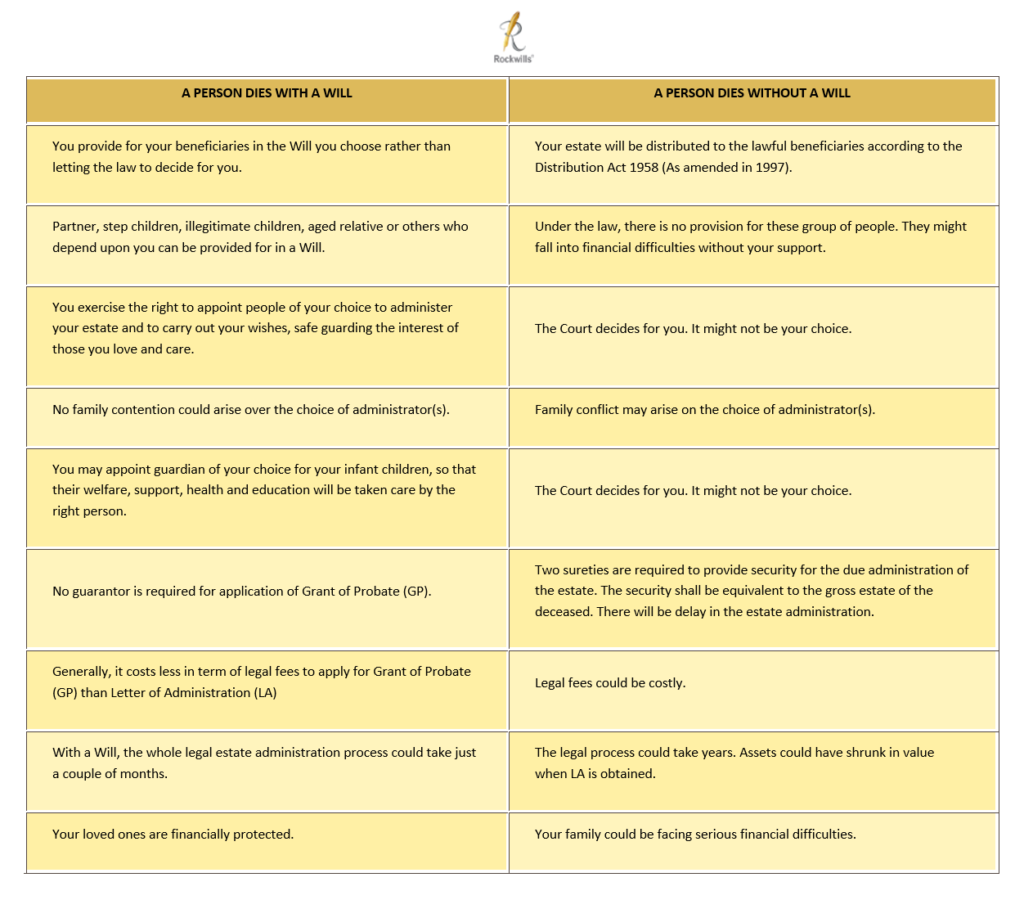

Without a Will, your assets could give more troubles than benefit to your family at a time when they are most vulnerable. Your loved ones could be involved in a long drawn legal process or fighting in a complex legal battle with other family members.

Without a Will, the law will decides who your beneficiaries, trustees and guardian would be. There is a legal process to go through before your loved ones can benefit from your assets. Leave nothing to chance. Make a Will and the law will protect your wishes.