Klik sini untuk versi BM.

For starters, let’s first explain what a Mortgage Assurance is.

Mortgage Assurance is a type of insurance that will cover your outstanding property loan a.k.a. mortgage if you are unable to do so in the event of death or total permanent disability.

Having a mortgage assurance policy will give you the peace of mind that in case anything happens to you, your dependents will not be burdened with settling your housing loan.

This is especially important if your family is still staying in the property that’s in the midst of being repaid.

In these unfortunate circumstances, at least your family can continue staying in the house without the added burden of having to continue servicing the loan.

Without this, the provider of the insurance, also known as the lender, will repossess your property and auction it off if your family fails to repay the remaining balance on the loan.

While Bank Negara Malaysia (BNM) doesn’t require mortgage insurance, many financial institutions are unlikely to lend to a home buyer if he doesn’t subscribe to a policy.

A bank may even offer a slightly lower interest if they do. However, BNM allows borrowers to take-up a mortgage insurance being sold by other companies not just the one offered by the lender providing the housing loan.

In Malaysia, there are two types of insurance offered for housing loans – Mortgage Reducing Term Assurance (MRTA) and Mortgage Level Term Assurance (MLTA). Each comes with different perks and disadvantages.

They are defined as such:

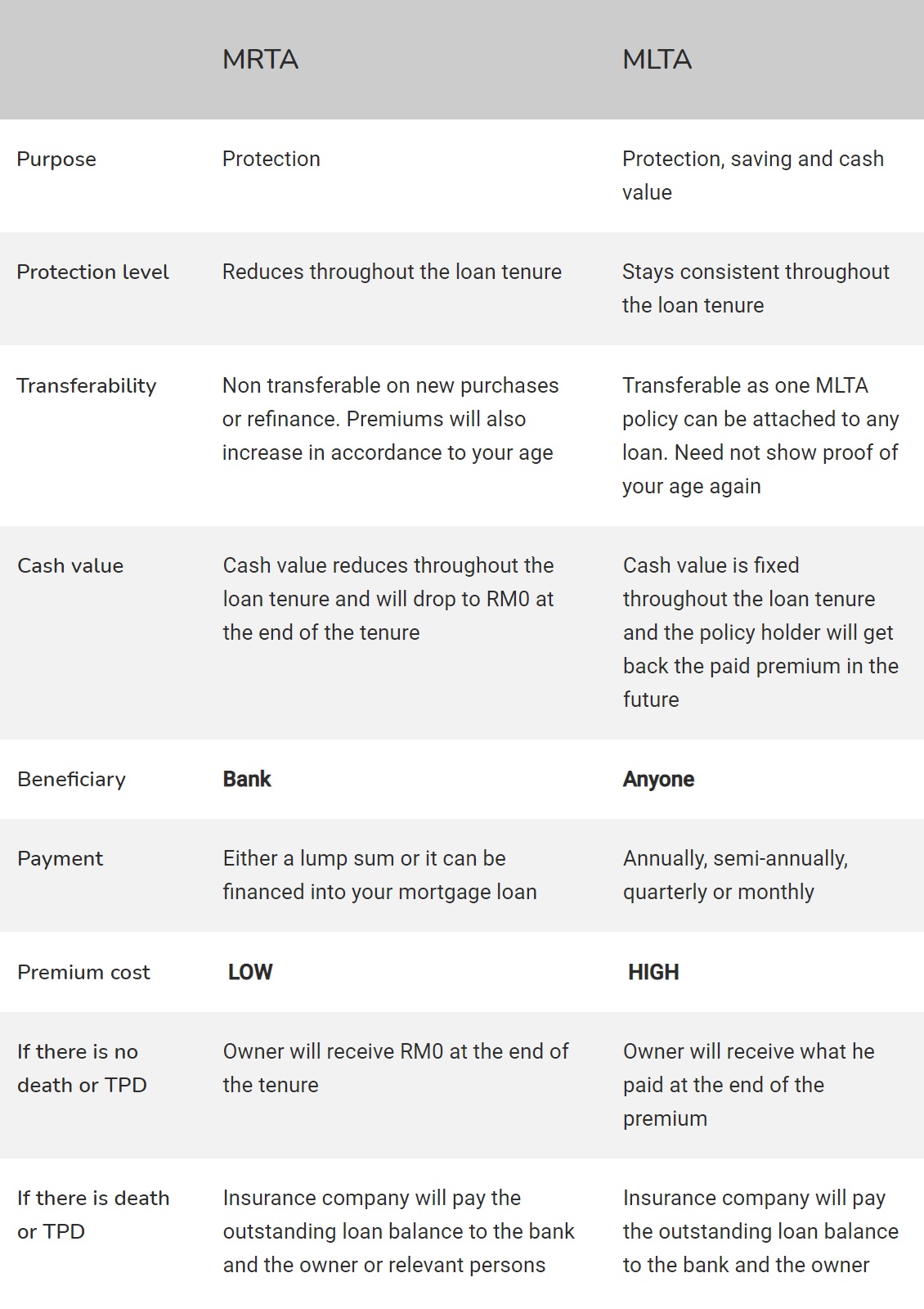

- MRTA – A life insurance plan with a decreasing sum assured over time, used to pay your outstanding home loan in the event of death or total permanent disability.

- MLTA – Similar to MRTA, except that it has a constant sum assured over time, and the pay-out is to the outstanding home loan AND your nominated beneficiary.

We compare both and discuss in more detail below!

Which Is More Expensive?

The insurance premiums for MRTA or MLTA depends on your age, the insured loan amount and how long the mortgage will be repaid.

Basically, you will be paying a higher premium if you are older, insuring a greater loan quantum and will be repaying the loan for a longer time.

In addition, you need to undergo a medical check-up to qualify for either. If a serious illness is discovered, the insurance provider might reject you or raise the premium.

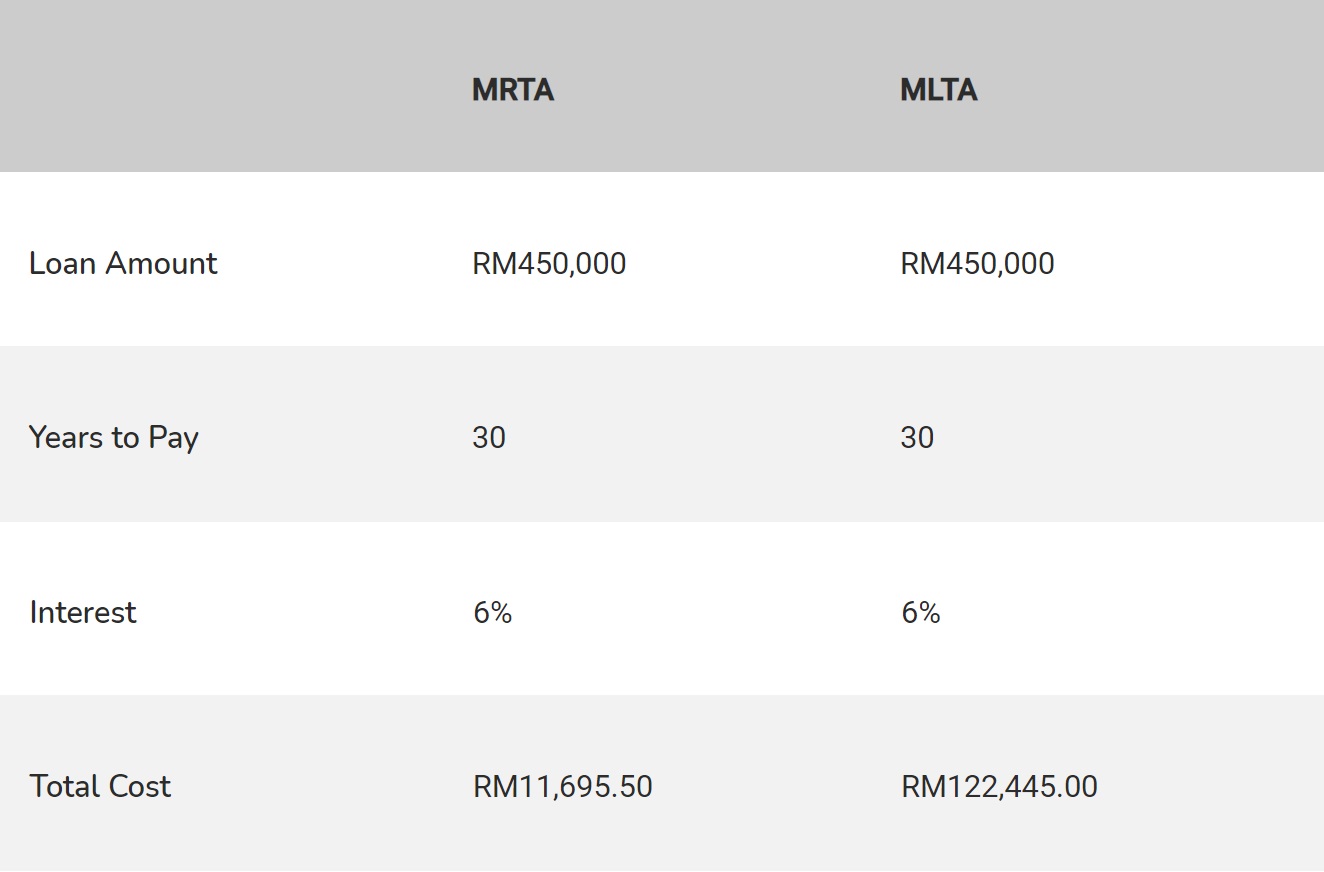

But basically, it’s generally known that a MRTA is about ten times more affordable than MLTA. For example:

A 28-year old Malaysian took out a RM450,000 housing loan with a tenure of 30 years and interest rate of 6% for a property costing RM500,000, he only needs to fork out a one-time payment of RM11,695.50 to secure an MRTA insurance policy.

There is also lower cash outlay on your part as MRTA can be bundled together with your mortgage.

On the other hand, if you acquire an MLTA insurance policy, you need to pay insurance premiums of RM357.13 per month or RM4,081.50 per annum. Over the 30-year tenure of the mortgage, the premiums will total RM122,445.

Which Offers Greater Protection?

MLTA offers greater protection as the amount insured remains the same throughout the life of the loan, even though the amount that you owe the bank will decrease over the years.

This means that on top of mortgage protection, an MLTA also is also a form of savings and has a guaranteed fixed cash value throughout the tenure of the loan.

In comparison, the amount insured under MRTA declines each year and will reach zero at the end of 30 years.

Moreover, only the lender will be entitled to the insurance payout under MRTA, while you can nominate anyone to be the beneficiary under an MLTA insurance policy.

Furthermore, since the MRTA is calculated based on the loan amount plus interest rates at the time of purchase, and since home loan interest rates in Malaysia can increase, there’s a risk that the MRTA’s value declines at a faster rate than the remaining loan value.

Here’s a simplified example:

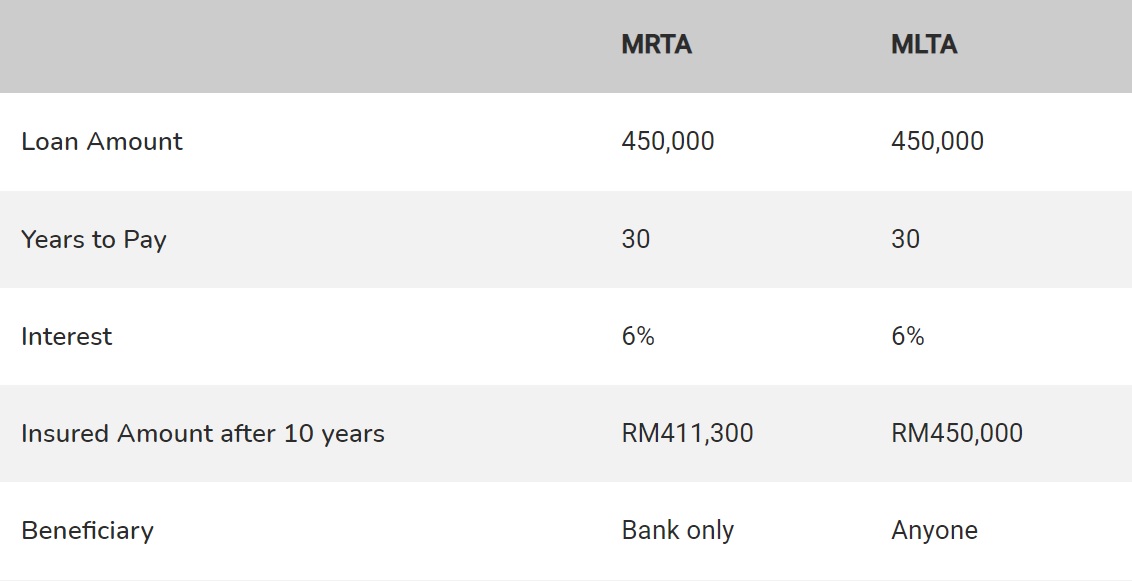

Under an MRTA scenario, if a borrower has been diligently paying his RM450,000 housing loan but suffered death or permanent disability after 10 years, the bank will receive RM411,300 from the insurance provider to pay off the loan.

If there has been an increase in interest rates, this amount may be insufficient to cover the remaining loan balance.

This means the borrower’s family may still need to fork out some cash to fully repay the mortgage, otherwise they’ll lose their home.

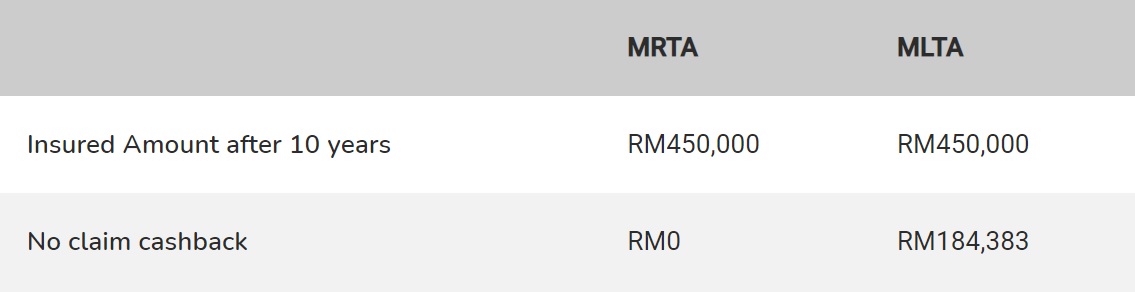

If there are no untoward incidents and the borrower successfully pays off the loan in 30 years, he/she will get nothing from the MRTA policy.

Safe to say, he/she would not have accumulated any savings that can be cashed in upon maturity of the policy.

Under an MLTA scenario, if anything happens to you, your family will always receive RM450,000 from the insurance provider to pay off the remaining balance of the housing loan.

Any difference between what is owed to the bank and the value of the policy will go to your family. This is why an MLTA is often regarded as a form of life insurance as well.

Aside from that, if the borrower is still alive and well after 30 years and the housing loan to the bank has been repaid, you will get RM184,383 from the insurance provider.

This means the you will get back the RM122,445 insurance premiums you’ve paid in all, plus an extra RM61,938. But if you took out an MRTA insurance, you’ll get nothing.

MRTA Or MLTA: Which Should I Choose?

It depends on your situation. If you don’t have many dependents relying on you financially, then applying for an MRTA is more advisable.

But if you have a large family and you’re supporting them financially, it’s better to subscribe to an MLTA policy due to the consistent and higher insurance payout.

MRTA is also more preferable for those buying a home for long-term occupation. This is because it’s not easy to transfer the insurance just in case you sell your house.

On the other hand, MLTA can be easily transferred, making it ideal for investment properties.

But among the key considerations is whether you’ll have enough budget to pay the premiums for an MLTA policy throughout the life of the loan.

If you think you will struggle to service those monthly or annual premiums, it’s better to stick with an MRTA insurance.

Furthermore, if you have other medical and life insurances that you think are enough for your dependents, it’s advisable to get an MRTA. But if you don’t have any other insurance, it’s best to get a MLTA policy.

How Do I Apply For A Mortgage Assurance?

Your lending bank generally will offer you their own MRTA or MLTA policies when you take up a housing loan with them. However, you are not obliged to take the policy from your lending bank.

You can also take up mortgage assurance policies from other insurance companies.

Taking the time to shop around for the best deal can be beneficial because different companies may have differing calculations for your premium depending on your age and health condition.